Renters Insurance in and around New Hartford

Your renters insurance search is over, New Hartford

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- New Hartford

- Utica

- Rome

- Oneida County

- Whitesboro

Calling All New Hartford Renters!

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is good to have, whether or not your landlord requires it.

Your renters insurance search is over, New Hartford

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

It's likely that your landlord's insurance only covers the structure of the townhome or home you're renting. So, if you want to protect your valuables - such as a couch, a bedding set or a guitar - renters insurance is what you're looking for. State Farm agent Mark Kotary has the knowledge needed to help you evaluate your risks and insure your precious valuables.

Don’t let concerns about protecting your personal belongings make you unsettled! Reach out to State Farm Agent Mark Kotary today, and see the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Mark at (315) 736-5212 or visit our FAQ page.

Simple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

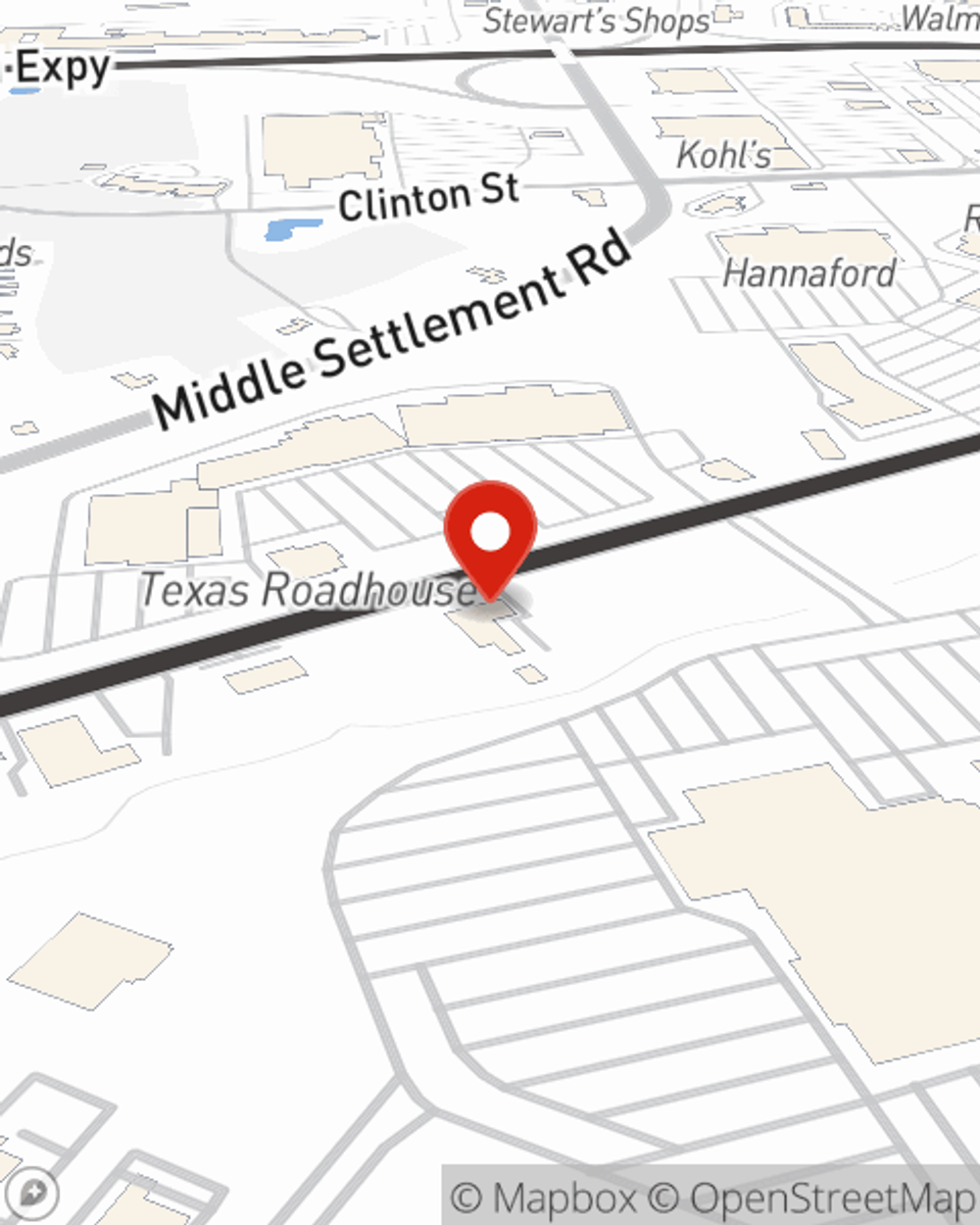

Mark Kotary

State Farm® Insurance AgentSimple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.